When Is the Best Time to Pay Your Credit Card Bill?

Published on: 03/13/2023

The best time to pay your credit card bill is on or before your due date. Most credit cards work on a monthly billing cycle, with the same payment due date each month. Making at least the minimum payment towards your statement balance on your due date ensures your credit card payments are on time.

If you want to pay down credit card debt and need to know how to build credit by paying your credit card bill, read this post to learn the best time to pay.

When should I pay my credit card bill?

Generally, if you make on-time payments, have a credit utilization ratio (CUR) of 30% or less and aren’t carrying a high balance, paying your credit card bill by the due date each month should have a positive impact on your credit score and financial health.

There are some situations where it might make sense to pay your credit card bill earlier. If you make a payment before your statement closing date, keep in mind that you’ll still need to pay your last statement balance by the due date to avoid being charged late fees or interest.

If you're carrying a balance, consider paying early

If you’re carrying a high credit card balance, making one or more payments to your credit card bill early may reduce the amount of interest you’re charged because the payments reduce your average daily balance. Also, if you’re accruing interest charges on an existing balance, paying before your closing date could reduce the total amount of interest you have to pay.

How this works depends on how your credit card issuer calculates your interest rate. Some issuers calculate interest on accounts using a daily periodic interest rate. A daily periodic interest rate generally calculates interest by multiplying the rate of the amount owed at the end of each day. That means the interest you accrue the first day your balance carries over becomes part of the balance against which interest is charged the next day. This continues to compound every day in your billing cycle, which can add up.[1]

If you have a CUR above 30%, consider paying early

If your credit card balance often exceeds 30% of your available credit, it might have a negative impact on your credit score. Paying more than the minimum by making early payments could help you reduce your credit utilization ratio (CUR)[2], which impacts your amounts owed, a factor that makes up 30% of your FICO® score.

Your CUR is your total revolving debt divided by your total revolving credit limits. If you use a lot of your available credit often, your CUR increases, which might signal to lenders that you have a difficult time managing your finances without credit. Experts suggest keeping your credit utilization ratio below 30%. Keeping your CUR under 10% may have the most positive impact on your credit.[2]

If you pay in full each month, pay by the due date

If you can pay the full balance on your credit card off each month, you just need to pay by the due date to avoid being charged interest and fees. Plus if your card issuer offers a grace period for your card, you can also avoid being charged interest on new purchases as well.[3]

Paying your credit card bill on time generally has a positive impact on your credit score because payment history is the most important factor in credit scoring. It accounts for 35% of your FICO® score[4] and 40% of your VantageScore®[5], affecting your credit score more than any other scoring factor.

It isn’t true that carrying a balance on your credit card from month to month is good for your credit score. This will just cause you to accrue interest.[6] Paying your balance off on time and in full each month is the best way to avoid accruing interest.

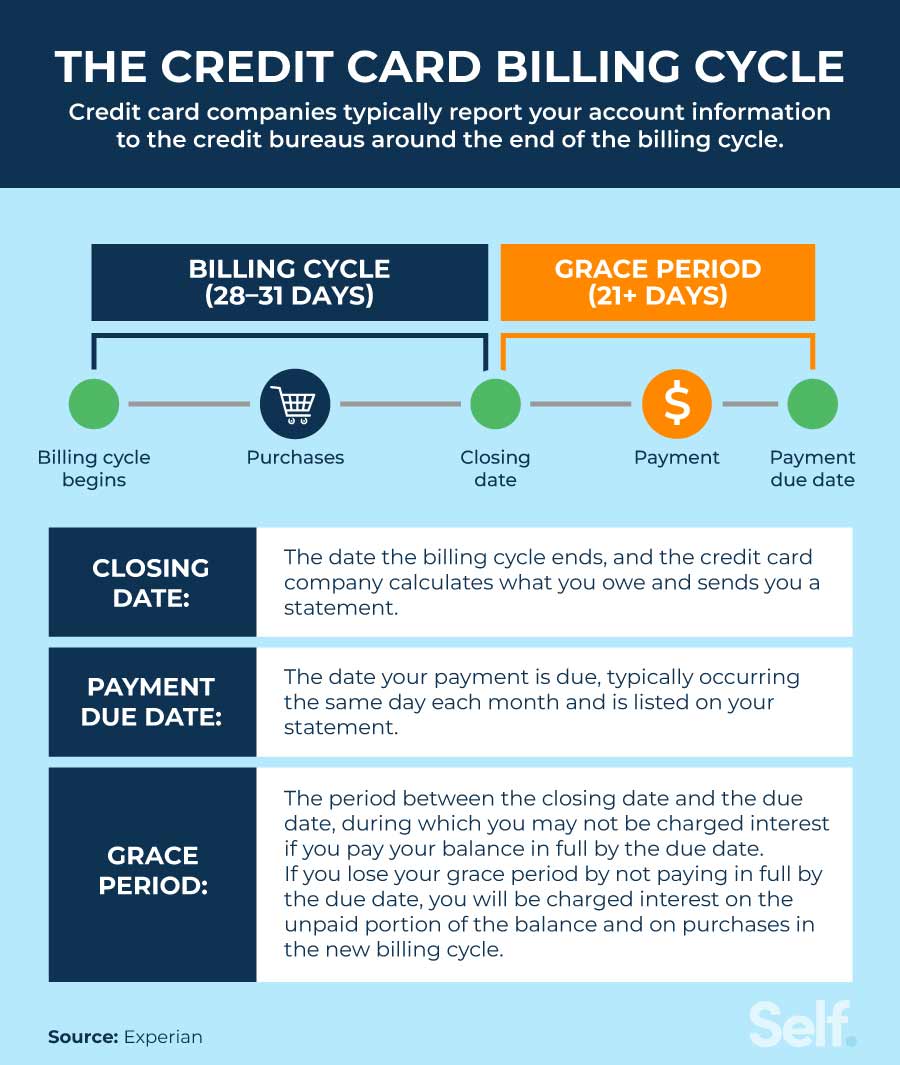

How the credit card billing cycle works

A credit card billing cycle is the period of time between statement closing dates. It’s typically 28 to 31 days long.[7]

The statement closing date is when the billing cycle ends and what you owe, including purchases, unpaid balances and any applicable fees and interest as well as credits you redeemed or payments you’ve made is calculated and becomes your statement balance. The due date is when at least your minimum payment of the statement balance is due. Your payment date typically falls 21 to 25 days after the statement closing date.

Paying before the statement closing date may decrease CUR

If you have a high CUR, make sure you pay at least your minimum payment by your due date. However, if you’ve saved some money and can pay more than your minimum, make that extra payment before your statement closing date. It will lower your CUR and the amount you owe on the next statement billing cycle. This may both improve your CUR and lower the credit card balance that your card issuer reports to credit bureaus, which shows up on your credit report.[7]

Credit card companies typically report your credit card account information to credit bureaus around the end of the billing cycle. The balance they report to the credit bureaus is typically what gets included in your CUR. Making a payment before the closing date, or multiple payments throughout the month, reduces the balance they report. But make sure you make a payment by your due date.

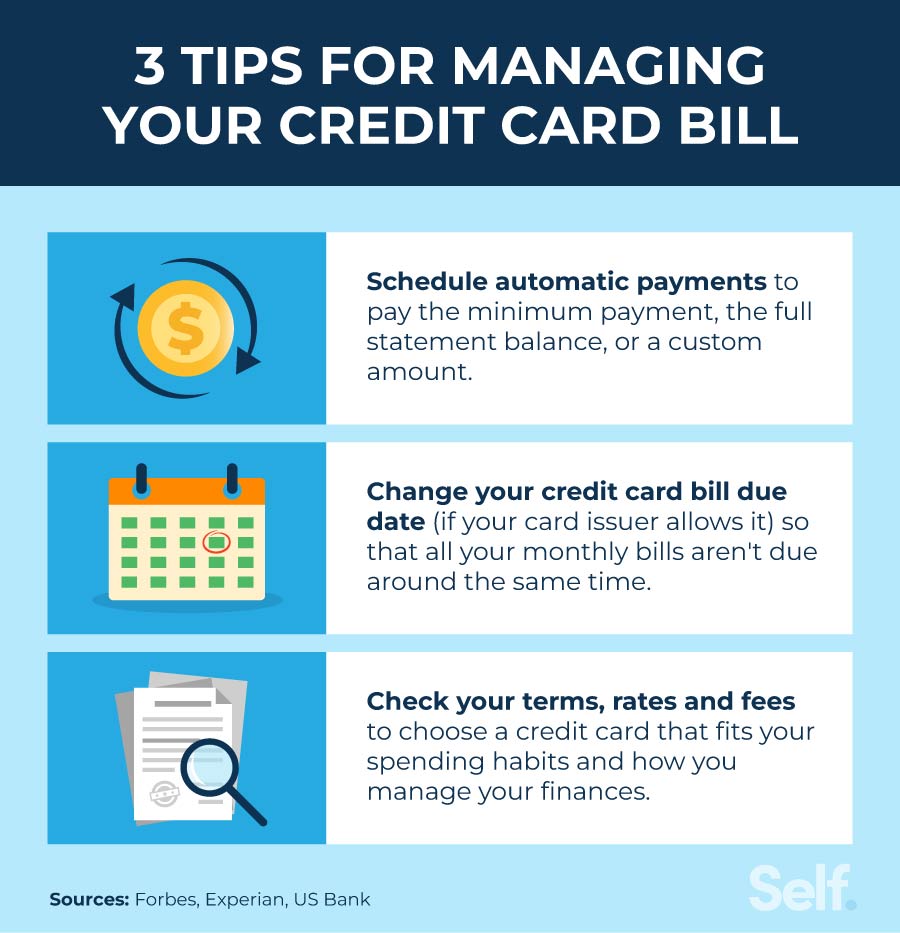

Tips for managing your credit card bill

Managing your credit card bill can be challenging, especially if you’re dealing with multiple accounts and other responsibilities. Here are some tips to help make it easier.

1. Set up autopay

If you struggle with remembering to make monthly payments on time, scheduling automatic payments to pay either your minimum balance or your full statement balance can help keep you on track. Autopay automatically pays the amount you owe using a linked bank account, helping you avoid late payments and fees. If you schedule automatic payments, make sure you’ll have enough money in your account to avoid overdraft or insufficient fund fees.[8]

2. Change your credit card due date

If you have multiple payments due around the same time each month, it can be difficult to manage your budget. Changing your credit card due date can help by moving when you have to pay your balance to a different part of the month. Check with your issuer to see if this is possible.[9]

3. Check your terms, rates and fees

Knowing the terms of your credit card — plus all related rates and fees, and if they increase — can help you choose the best credit card for your needs.[10] Read through your cardholder agreement as well as each credit card statement to understand what you’re being charged.

For example, if you sometimes make late payments, you might want to look for a card that’s more lenient on late fees. A report by the Consumer Financial Protection Bureau found that card issuers charged cardholders over $12 billion in late fees in 2020 alone.[11] So it isn’t only how you use the card, but also what card you use that affects what you owe and how your credit is impacted.

Pay at least the minimum

The best time to pay your credit card bill is always by the due date. But, if you’re carrying a balance, you might benefit from paying early, as long as you still make your monthly payment towards your statement balance on time.

If you manage your accounts well, paying at least the minimum payment on your credit card bill by the due date can add positive payment history to your credit report. Even if you’re dealing with poor or limited credit, don’t give up — keep working on making your monthly payments on time because building a solid credit history takes time. If you’re trying to build your credit score, Self’s products may be able to help.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Consumer Financial Protection Bureau. “What is a ‘daily periodic rate’ on a credit card?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-daily-periodic-rate-on-a-credit-card-en-46/. Accessed December 30, 2022.

- myFICO®. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed December 30, 2022.

- Experian. “How Do Credit Card Payments Work?” https://www.experian.com/blogs/ask-experian/how-do-you-pay-a-credit-card-bill/. Accessed December 30, 2022.

- myFICO®. “How are FICO® Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed December 30, 2022.

- VantageScore®. “The Complete Guide to Your VantageScore®,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed December 30, 2022.

- Experian. “Will Paying My Credit Card Balance Every Month Help My Credit Score?” https://www.experian.com/blogs/ask-experian/better-pay-off-credit-card-full-every-month-or-maintain-balance/. Accessed December 30, 2022.

- Experian. “What Is a Billing Cycle?” https://www.experian.com/blogs/ask-experian/what-is-billing-cycle/. Accessed December 30, 2022.

- Forbes. “What Is Credit Card Autopay And How Does It Work?” https://www.forbes.com/advisor/credit-cards/what-is-credit-card-autopay-and-how-does-it-work/. Accessed December 30, 2022.

- Experian. “How to Change Your Credit Card Due Date,” https://www.experian.com/blogs/ask-experian/how-to-change-credit-card-due-date/. Accessed December 30, 2022.

- U.S. Bank. “5 tips to use your credit card wisely and steer clear of debt,” https://www.usbank.com/financialiq/manage-your-household/manage-debt/use-credit-card-wisely-steer-clear-of-debt.html. Accessed December 30, 2022.

- Consumer Financial Protection Bureau. “Credit card late fees,” https://files.consumerfinance.gov/f/documents/cfpb_credit-card-late-fees_report_2022-03.pdf. Accessed December 30, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).